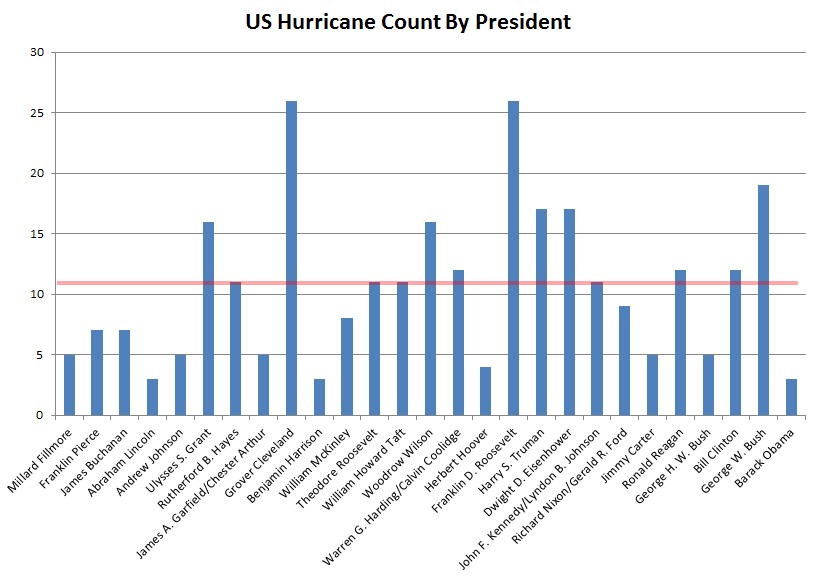

The extraordinary decline in hurricanes--Barack Obama's Presidency has seen the lowest numbers since Grover Cleveland was in the White House--combined with the lowest tornado count since the Weather Service (then Bureau) began issuing tornado warnings, means that U.S. insurers and reinsurers are taking in the premiums without paying the big claims.

From Reuters Alpha Now:

Allstate Earnings Seem To Be In ‘Good Hands’

When disaster strikes, insurance companies take a hit. The third quarter was fairly quiet on the catastrophe front, except for the Colorado floods. Unfortunately for the residents, much of that damage was uninsured. When claims are low and interest rates rise, property and casualty firms benefit. It looks like Allstate Corp (ALL.N) is likely to beat estimates when it reports third quarter earnings on Oct. 30.

Allstate’s motto is “you’re in good hands,” and it looks like that principle applied to the balance sheet for the last quarter.

The Thomson Reuters StarMine SmartEstimate and the I/B/E/S consensus estimate were at about the same level for most of the quarter. However in the last 30 days, several analysts raised their estimates, based on the lower catastrophic losses the company is likely to report.

Source: Thomson Reuters Eikon/StarMine

Two Bold Estimates

Since Oct. 1, nine analysts have updated their estimates, and all of them are more than 10 cents above the consensus. In fact, there are two StarMine Bold Estimates for the company. These estimates by 5-star rated analysts, the highest StarMine rating, are far above the consensus estimate. It explains why the StarMine SmartEstimate is now so much higher than the consensus, which now stands at $1.22 per share compared to the SmartEstimate at $1.44.

Source: Thomson Reuters Eikon/StarMine

Higher investment returnsU.S. hurricane count by presidency:

The operating profit ratio, a measure of operating efficiency at insurance companies, has been trending higher. As interest rates increase, so do the returns that the company receives from its investments in risk-free bonds. In a rising interest rate environment, which is in large part due to the expectation of a Fed taper, operating profit ratios are likely to remain robust....MORE