Er, what lower bound? And $5.5tn worth of negative nuts

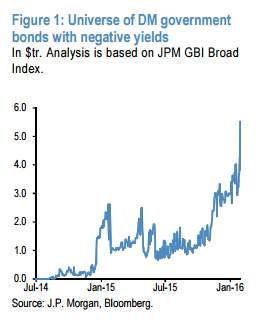

ICYMI, and on the back of the BoJ going negative, “the universe of DM government bonds trading with a negative yield rose to a record high of $5.5tr, or 24% of the JPM Global Government Bond Index,” according to JPM.

And it’s probably going to get nuttier, what with yield seekers now leaking out of Japan and into the global bond markets at, presumably, a greater pace. From JPM again, with our emphasis:

The BoJ reinforced this year’s decline in global government bond yields even as risky markets rebounded. The rally was not confined to JGBs, but spread across core government bond markets in anticipation that the search for yield will leak out of Japan into European and US government bond markets. That leakage has been strong over the past year. During 2015, Japanese investors bought on average $2bn per week of foreign bonds. Today’s shift in BoJ policy will most likely strengthen Japanese investors’ foreign bond purchases going forward.Now, you would be right to consider this as an addendum to Gavyn Davies BoJ post explaining the structure of the BoJ’s new negative rates regime. He makes the point that the BoJ’s move is limited via tiering because of a desire to protect bank profitability and stop banks hoarding liquidity via banknotes — without resorting to a Gesell tax, cash ban type solution, that is.

This expansion of the universe of negative yielding bonds is creating problems for the ECB. The amount of euro area government bonds trading with yield less than -40bps (the assumed ECB depo rate from March onwards) and with maturity greater than two years, increased sharply to above €250bn, of which €200bn are German (Figure 2). At the moment, around 6% of the €4.2tr universe of 2y-30y euro area government bonds and around 19% of the €740bn universe of 2y-30y German government bonds are trading below -40bp, making them ineligible for the ECB’s bond purchase program, even after assuming a depo rate cut to -40bp in March. In other words, the BoJ’s policy actions are effectively forcing the ECB to chase its own tail and extend the duration of its purchases.

… because of continued QE-related bond purchases, the portion of reserves subjected to the negative depo rate will likely rise from 1-2% currently towards 15% into 2017

As Davies wrote, “under the new BoJ plan, any shift by banks into cash will be penalised by increasing the scale of the reserves at the central bank that will be charged the negative rate. So the problem of a drain into cash as policy rates dive into increasingly negative territory is mitigated.”...MORE