From David Keohane at FT Alphaville:

Soooooon, passive vs active edition

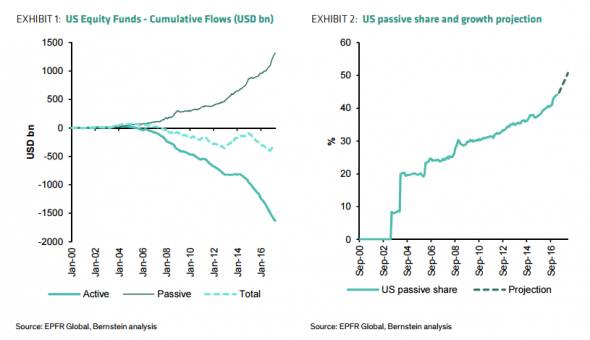

At some point in the next nine months a historic milestone will be passed. More than half of managed equity assets in the US will be run on a passive basis (for global equities the figure is 38%). At the current rate we forecast that this will happen sometime in January 2018. We don’t think that there will ever be any reversion back past this point, so from here on the majority of equity AUM in the US will be passive. In this short note we consider what this means.That’s from Bernstein’s Inigo Fraser Jenkins and team. The charted version looks like this:

While the less intimidating version points out that when other holders of equities — retail, corporates holding their own stocks, SWFs etc — are taken into account, expressed as a share of market cap, passive is “only” 14.5 per cent, according to Bernstein.

And yes, this is the same Bernstein team which previously suggested that passive investing was worse than Marxism and ranked capital markets thus:

Their argument is/was that markets exist to allocate capital and passively dominated markets won’t allocate it very well since there won’t be active managers doing the necessary fundamental legwork. Or: “In a Marxist society at least someone is doing the planning of capital allocation, but in a predominantly passive market then the capital allocation process is done by a marginal participant.”

- Capitalist society with functioning capital markets

- Marxism

- Capitalist society with predominantly passive capital markets

There are numerous potential problems with this which have already been raised. For one, there is an argument, put forward by Credit Suisse’s Mauboussin earlier this year, that the shift away from active might actually be good for market efficiency:

Investors are shifting their investment allocations from active to passive management. This trend has accelerated in recent years. The investors who are shifting from active to passive are less informed than those who stay. This is equivalent to the weak players leaving the poker table. Since the winners need losers, this can make the market even more efficient, and hence less attractive, for those who remain. If you can’t identify the patsy, or weak player, it’s probably you…But even if you buy Bernstein’s side, their operative word is “predominantly” since the argument is that at some advanced level of passive domination the capital allocation function of the market will be damaged. It’s an argument that makes logical sense for an undefined level of passive domination.

Small and unsophisticated investors should build passive portfolios, with an emphasis on asset allocation and low cost. Sophisticated investors should seek active managers in asset classes with high dispersion. There are ways to assess money managers beyond past performance that may shade the odds in your favor

More so, it’s unclear that a level high enough to be damaging to the market will be reached — arguably as soon as the market starts to become dysfunctional it will pay active managers to jump back in. That’s what those like Burton Malkiel who are passive fans would say, anyway....MUCH MORE